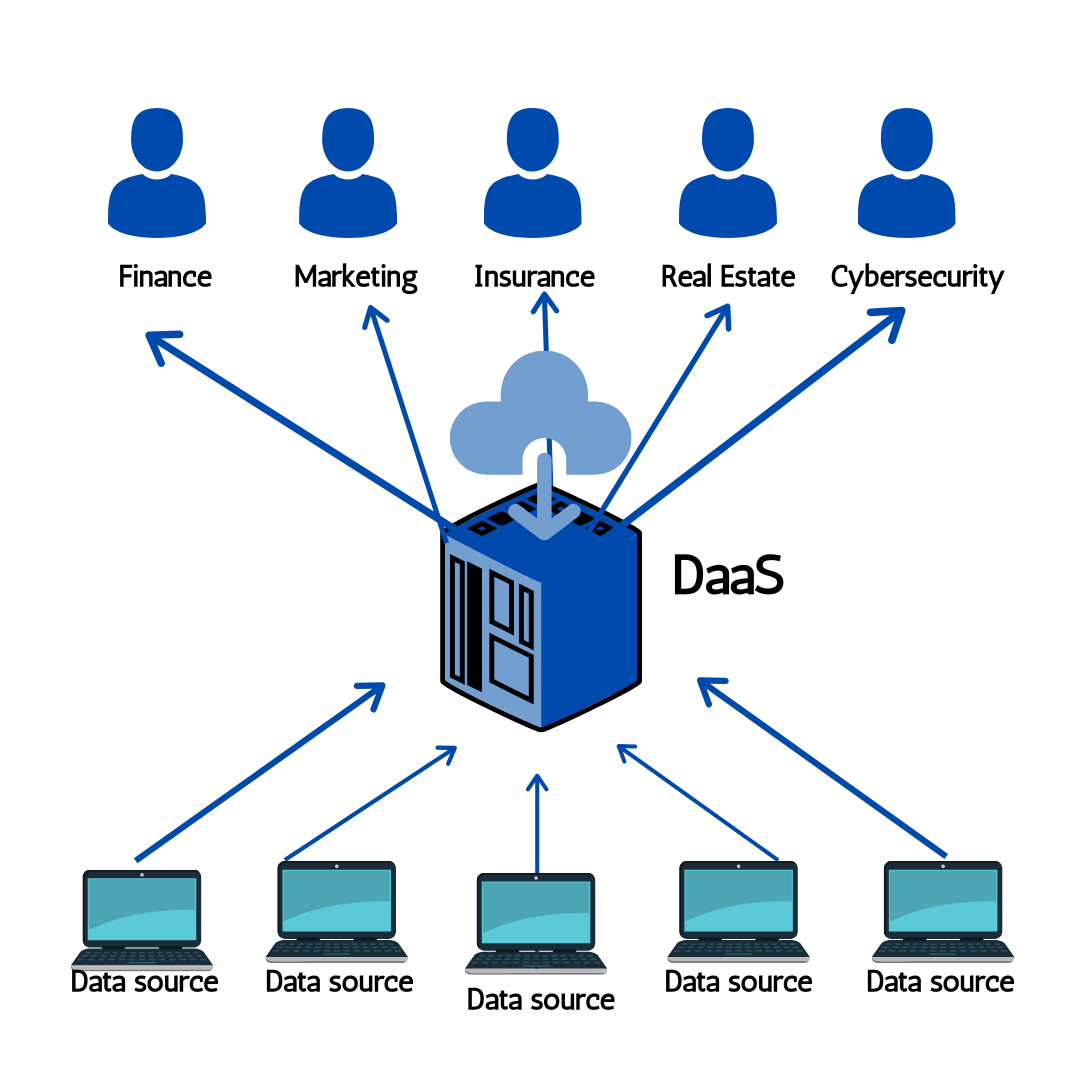

The Data as a Service (DaaS) market is a dynamic arena for strategic Data as a Service (DaaS) Industry Mergers & Acquisitions, with M&A serving as the primary vehicle for companies to acquire unique data assets, new technologies, and specialized domain expertise. The transactions in this space are not just financial maneuvers; they are highly strategic moves designed to build a more defensible competitive position in the high-stakes information economy. The most significant and powerful driver of M&A is the quest for proprietary and alternative data. In a world awash with information, the ability to own a unique, predictive, and hard-to-replicate dataset is the ultimate source of a competitive advantage. This has turned the M&A market into a "gold rush," with large, established data providers, financial institutions, and even private equity firms aggressively acquiring smaller companies that have managed to create or gain exclusive access to a valuable data stream. The targets are often companies that have developed novel methods for collecting and processing data, such as analyzing satellite imagery, scraping the web at scale, or partnering with companies to access anonymized consumer transaction data. The goal of the acquirer is simple: to own the data that no one else has.

The landmark merger of S&P Global and IHS Markit is a quintessential example of this data-driven M&A strategy on a mega-scale. This was not just a merger of two companies, but a fusion of two immense and highly complementary data empires. S&P Global brought its deep, authoritative data on public companies and financial markets, while IHS Markit brought its leading datasets in areas like energy, automotive, and maritime industries. The combination created a single data superpower with an unparalleled breadth and depth of proprietary information, able to serve a vast range of customers from Wall Street to the world's largest industrial corporations. This type of large-scale, strategic merger is designed to create a "one-stop-shop" for business and financial intelligence, making the combined entity an even more indispensable partner to its clients and creating an even higher barrier to entry for any potential competitor.

Beyond the acquisition of data assets, another key motivation for M&A is the acquisition of technology, particularly in the areas of artificial intelligence and data management. A traditional data broker with a valuable but messy dataset might acquire a startup that has developed a superior AI-powered platform for cleaning, structuring, and enriching that data. This allows the acquirer to dramatically improve the quality and utility of its core product. Similarly, a data provider might acquire a company with a more modern, API-first data delivery platform to help it accelerate its own digital transformation and to better serve the needs of its developer and data science customers. These technology "tuck-in" acquisitions are a crucial way for the established incumbents to stay agile and to keep pace with the rapid pace of technological change in the data industry. The M&A activity in the DaaS market is therefore a high-stakes game of assembling the best portfolio of both unique data and the advanced technology needed to process and deliver it. The Data as a Service (DaaS) Market size is projected to grow to USD 75.2 Billion by 2035, exhibiting a CAGR of 17.23% during the forecast period 2025-2035.

Top Trending Reports -

GCC Deep Packet Inspection Market