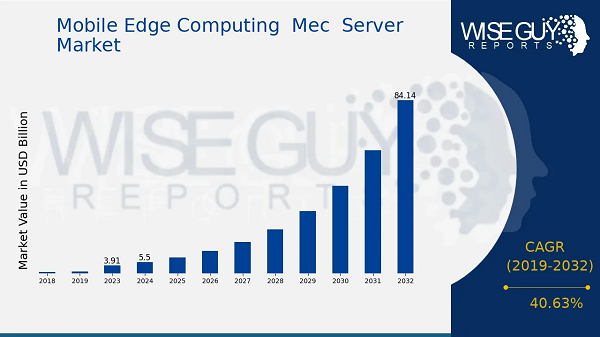

The advent of 5G and the insatiable demand for low-latency, high-bandwidth applications have catalyzed the emergence of a transformative new infrastructure layer, with its economic significance captured in a rapidly escalating market valuation. A thorough investigation of the Mobile Edge Computing MEC Server Market Valuation reveals a multi-billion-dollar industry that is foundational to the next generation of digital services. This substantial valuation is not merely a reflection of hardware sales but represents the total invested capital and perceived future value of deploying computational and storage resources at the periphery of the mobile network. The market's worth is a composite figure, aggregating the massive expenditures by mobile network operators (MNOs) to upgrade their radio access networks (RAN), the significant R&D and deployment costs incurred by cloud hyperscalers extending their services to the edge, and the enterprise investments in private MEC networks. As detailed in specialized market research, such as the analysis provided by Wise Guy Reports, this valuation is driven by the strategic imperative to process data closer to its source, thereby enabling a new class of latency-sensitive applications—from autonomous vehicles and augmented reality to real-time industrial automation—that are simply not feasible with a traditional centralized cloud architecture. The intrinsic value is derived from this unique capability to unlock new revenue streams and operational efficiencies, justifying the premium on the specialized, ruggedized, and high-performance server hardware and software platforms that constitute the core of this market.

Dissecting the components that contribute to the market’s overall valuation provides a clearer understanding of its complex financial structure. The hardware segment represents the largest and most tangible portion of the market's worth, encompassing the sales of high-density, small-form-factor servers specifically designed for deployment in harsh or space-constrained edge locations like cell towers, base station cabinets, and enterprise premises. These servers, often featuring specialized accelerators like GPUs and FPGAs for AI and video processing workloads, command a high price point. The software and platform segment is the second pillar of the valuation and is growing in significance. This includes virtualization platforms (like VMware and Red Hat), container orchestration engines (Kubernetes), and the sophisticated management and orchestration (MANO) software required to deploy and manage applications across thousands of distributed edge sites. The valuation of this segment is increasingly based on recurring revenue from subscriptions and licensing. Finally, the services segment, comprising system integration, network engineering, and managed services, constitutes a vital part of the total market value. The complexity of designing, deploying, and maintaining a distributed MEC infrastructure necessitates deep expertise, and the professional services contracts associated with these large-scale rollouts contribute significantly to the market's overall financial footprint.

Looking ahead, several key trends are poised to further amplify the market's valuation. The maturation of private 5G and MEC networks for enterprises is a primary catalyst. As industries like manufacturing, logistics, and healthcare build their own dedicated on-premise edge networks to power IoT and automation initiatives, it will drive a massive new wave of server procurement and software licensing, significantly boosting the market's worth. Furthermore, the development of a robust edge application ecosystem will be a major valuation amplifier. As more independent software vendors (ISVs) develop and monetize applications specifically for the edge, it will increase the perceived value and ROI of the underlying server infrastructure, encouraging further investment. The increasing use of AI at the edge, where models are run locally for real-time inference in applications like video surveillance, quality control, and retail analytics, will also contribute heavily, as this requires powerful, accelerator-rich servers that carry a higher average selling price. As the digital and physical worlds continue to converge, the critical role of MEC servers as the bridge between them will ensure the market's valuation continues its strong upward trajectory.